Peer-to-peer credit is when a single buyer or an institutional individual will bring debt capital to people or enterprises as a result of on the web attributes (generally a site). Its labeled as markets lending or choice financial support since it is an effective strategy outside the traditional business financing practice.

Just who advantages of fellow-to-peer credit?

The debtor while the financial will benefit off fellow-to-fellow funds. The lender’s work with is they create a stable income from interest money, which often surpass earnings of antique function eg Cds, preserving membership, and money business funds.

Into the borrower’s side, while the quantity of attention charged to have fellow-to-fellow loans may be higher than conventional loans, the words are usually far more versatile. The internet app processes is commonly quick and you will smoother.

P2P loan models

P2P finance already been as the personal unsecured loans but now tend to be providers finance also. Having a personal P2P financing, you could potentially use for all the courtroom goal, and you also don’t have to promise collateral discover approved getting that loan.

Signature loans would be the typical P2P loans, and they’re in addition to the most flexible. You could potentially harness the bucks to the debt consolidation, a separate automobile, renovations, or performing a corporate.

P2P business loans also can were organization auto loans, loans the real deal home, otherwise covering an initial-title dollars crunch. Smaller businesses and you will startups commonly utilize P2P finance the most.

Benefits of P2P lending

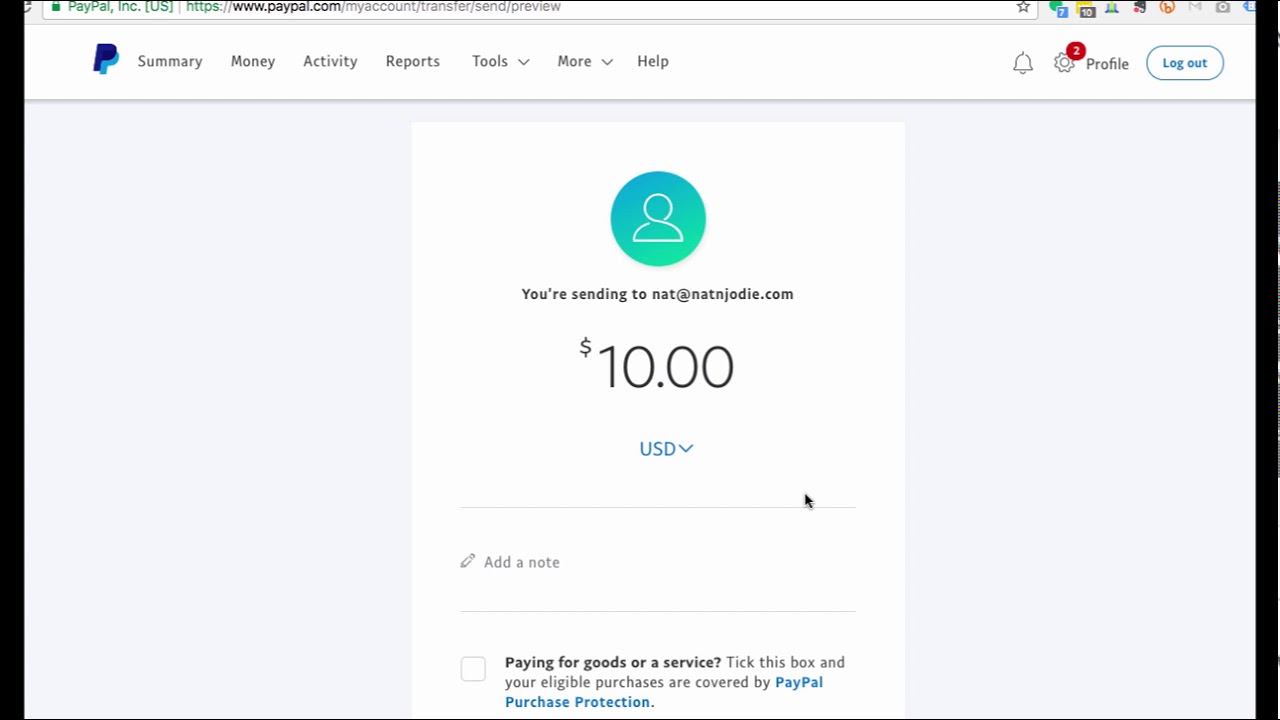

With peer-to-peer financing, borrowers usually do not apply at a financial or other conventional financial institution. Alternatively, they create a profile to your a webpage one to will act as a beneficial application for the loan. Traders following opinion the internet users, assuming they prefer whatever they look for, they give a loan to your applicants.

Borrowers commonly necessary to remove some of the funds it are provided. As an alternative, capable remark new terms and conditions and rates of interest created by individuals people, and they is also determine which you to that they like. Once they try not to discover financing that works well in their mind, they don’t have to take one. Throughout the P2P financing globe, it is also known as the latest public auction process.

If you decide to sign up for an equal-to-fellow loan, the latest P2P financing system produces a profile for your requirements, also details about your credit score and you may debt-to-earnings proportion. All P2P lender does this a little in different ways. Such as for example, particular loan providers may inform you applicants’ fico scores, although some will get assign A beneficial, B, otherwise C evaluations to help you consumers. Don’t get worried: Even though users are public to ensure that buyers are able to see her or him, they will not include the real name, making sure their confidentiality and cover.

Cons of P2P lending

If you find yourself credit ratings enjoy a huge part, loan providers and you may lending institutions are also looking the reasons why you you need financing. That it an element of the application shall be critical to attracting an effective financial or individual. An investor just who observes an enticing app can be probably be offer a loan to this applicant rather than one who will not certainly identify the purpose into the mortgage, even if the 2nd candidate keeps a far greater credit score.

Making an application for a peer-to-peer loan are perhaps faster than simply applying for a business loan using a bank, especially as the individuals won’t need to create extended company plans. not, P2P apps take more time than simply trying to get financing of online lenders and making an application for a charge card on the internet.

With lots of on line lenders and online charge card applications, a choice might be made in a matter of moments. To have on the web money america cash loans Montrose, particularly, financing can take place an identical day or even the 2nd business day. That have fellow-to-fellow financing, acceptance and you can investment times vary. Since the individuals must wait until a trader will get interested in its profiles, the procedure can take anywhere from a few minutes, a short time, for some days.